Indexed Universal Life Insurance (& Retirement)

Think life insurance can't be used to fund your retirement? Think annuities are only for retired individuals? Think Again.

Life insurance and annuities have progressed and adapted over the years. Many of the out-dated stereotypes no longer apply. Utilizing modern-day plans like indexed universal life insurance and fixed indexed annuities allow you to round out a well-balanced income plan that can meet both your long-term and short-term financial goals.

Indexed Universal Life Insurance (IUL) is a form of permanent life insurance. This insurance is designed to last your entire life, and guarantees that your beneficiary, at the time of your passing, will receive a financial benefit.

Indexed Universal Life insurance offers a unique combination of robust life insurance AND the potential to accumulate strong personal cash value. The accumulation value is both automatically linked to the upward movement of a particular stock index (like the S&P 500), and automatically protected from losses during an index's downward movement.

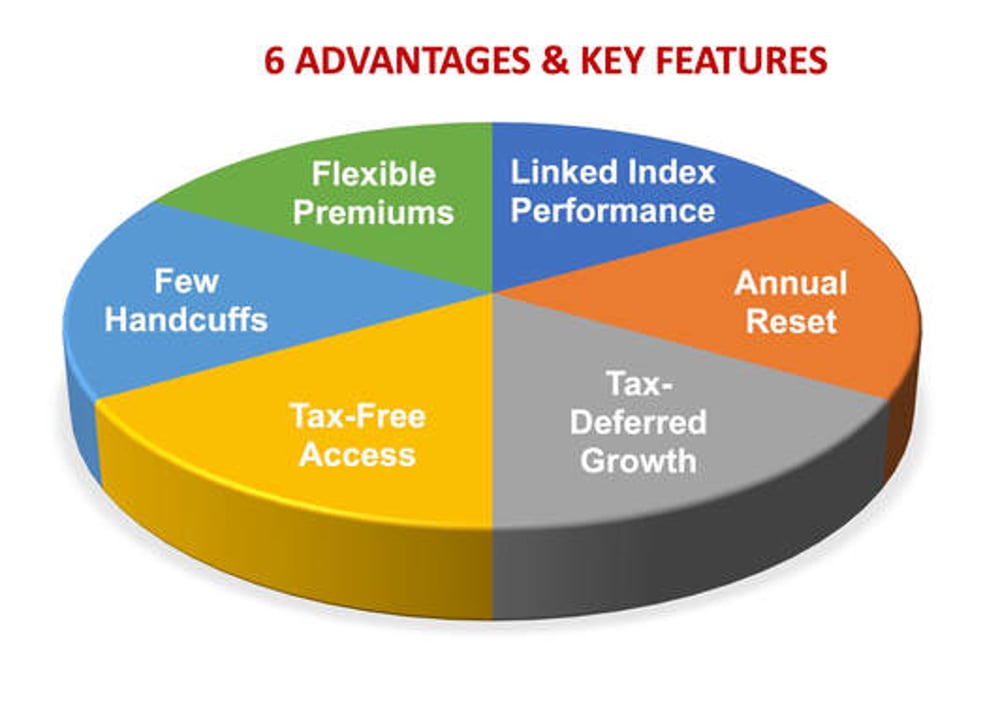

Below are 6 key features and advantages to indexed life insurance and annuities.