How IULs work

Think of your life insurance policy as a bucket and the water as your premium

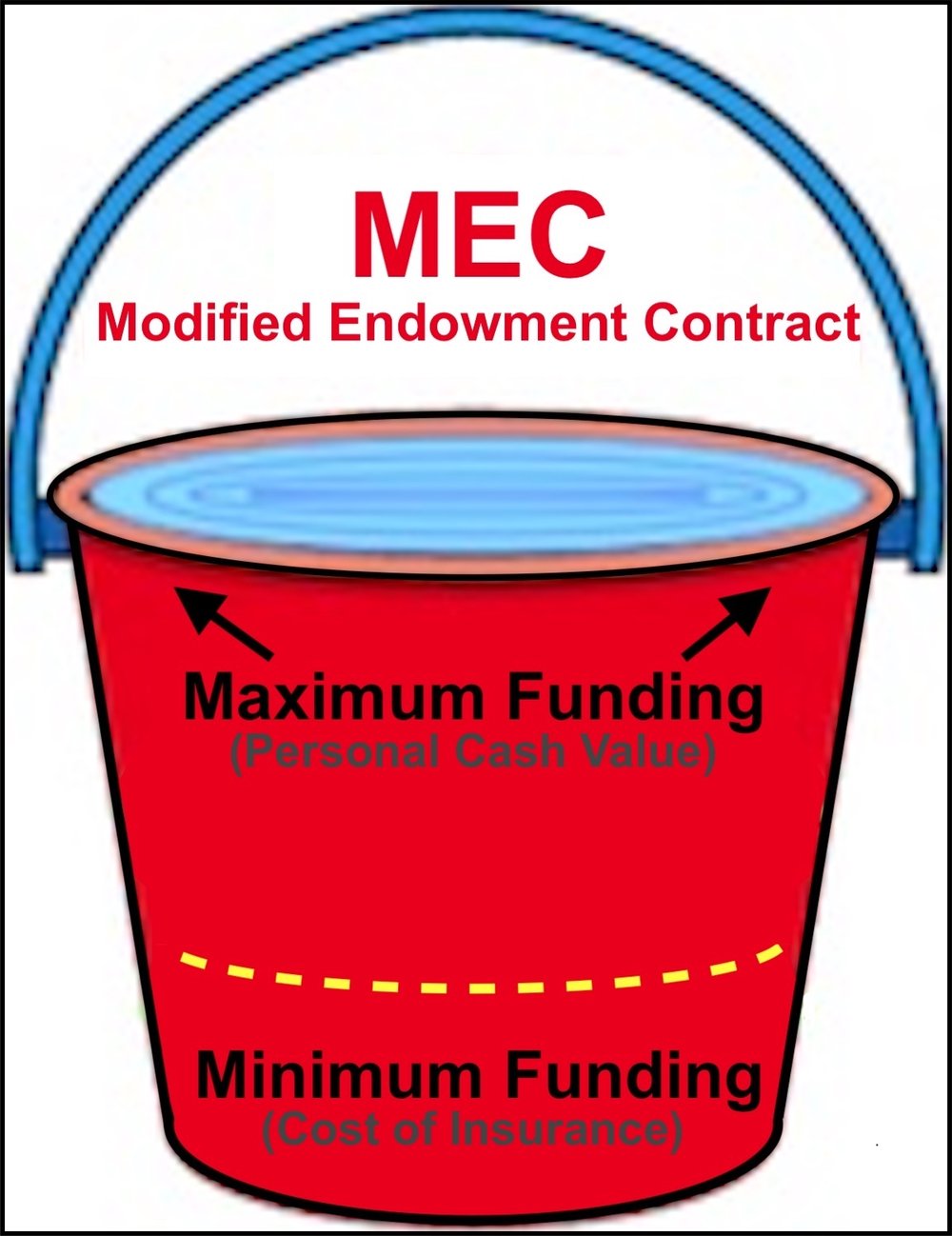

Indexed Universal Life (IUL) insurance policies have flexible premiums, meaning you can pay different amounts for nearly the same death benefit. To make sense of this, think of your premiums as water, and think of your insurance policy as a bucket. To utilize the highest potential for significant cash growth, the goal is to find the smallest bucket (ie. life Insurance policy) that can hold the maximum amount of water (ie. premiums) WITHOUT spilling over. This creates a "maximum funded" life insurance policy."

Modified EndowmentContract (MEC)

Overfill the bucket and you will reach a MEC status. In most cases this must be avoided.

Maximum Funded Premium

Fill the bucket completely full WITHOUT spilling over, and you will reach the Maximum Funded Premium. Ideal for maximum personal cash value inside the policy.

Minimum Funded Premium

Fill the bucket 1/3 full and you will reach the Minimum Premium. This is not recommended but can be utilized for short periods of time if money it tight.

How Premiums Fund Your Cash Value

Below is an example of how your premiums are credited on an annual basis. Using a premium of $250/month and the S&P 500 Annual Point to Point indexing strategy.

Year 1

Indexed Unv. Life

Policy Issued

*After approval by underwriting

Year 1

1st Monthly Premium: Jan. 15th

$250 Monthly Premium Paid

Year 1

Follow the S&P 500 for the Year

This is the "Annual Indexing Period"

Start Year 2

Index Credit

Jan. 15th

January-to-January GAINS are credited (to the cap) for a positive index return, or LOSSES are

protected (0%) from a negative index return.

Year 1

The Annual Reset

is Locked

Any GAINS are locked in and becomes the new "floor."

Year 1

2nd Monthly Premium: Feb. 15th

$250 Monthly Premium Paid

Year 1

Follow the S&P 500 for the Year

The Annual Indexing Period

Start Year 2

Index Credit

Feb. 15th

February-to-February GAINS are credited or LOSSES are protected.

Year 1

The Annual Reset

is Locked

GAINS are locked and becomes the new "floor."

Year 1

3rd Monthly Prem: March 15th

$250 Monthly Premium Paid

Year 1

Follow the S&P 500 for the Year

The Annual Indexing Period

Start Year 2

Index Credit

March 15th

March-to-March GAINS are credited or LOSSES are protected.

Summary of the figure above:

Your $250/month premium is paid on Jan. 15th at the beginning of Year #1. The insurance policy will mark this as the "start" date for the S&P 500 Index. On Jan. 14th of Year #2, the insurance company will mark this as the "stop" date.

The index is either credited for positive growth (to the cap), or posts a 0% credit for any negative losses.

On Feb. 15th of Year #1, the same process happens again, but this time the "stop" date is Feb. 14th of Year #2.

On March 15th of Year #1, the same thing.

This happens over and over again... for years and years and years. If done correctly, and through many years of consistent premium payments, there should be a time where you can quit making premium payments altogether and still maintain a very healthy life insurance policy for the rest of your life with a very substantial personal cash value account.

Is an IUL right for you?

Many individuals have heard about an Indexed Universal Life insurance policy, and think "this is too good to be true." But this couldn't be farther from the truth.

Moving forward with an IUL requires thought, planning, and dedication.

In fact, many people treat their IUL as they would any other retirement vehicle. Business Owners often utilize IUL's as a vehicle to retain key employees. The decision to move forward with an Indexed Universal Life insurance policy should not be made lightly.