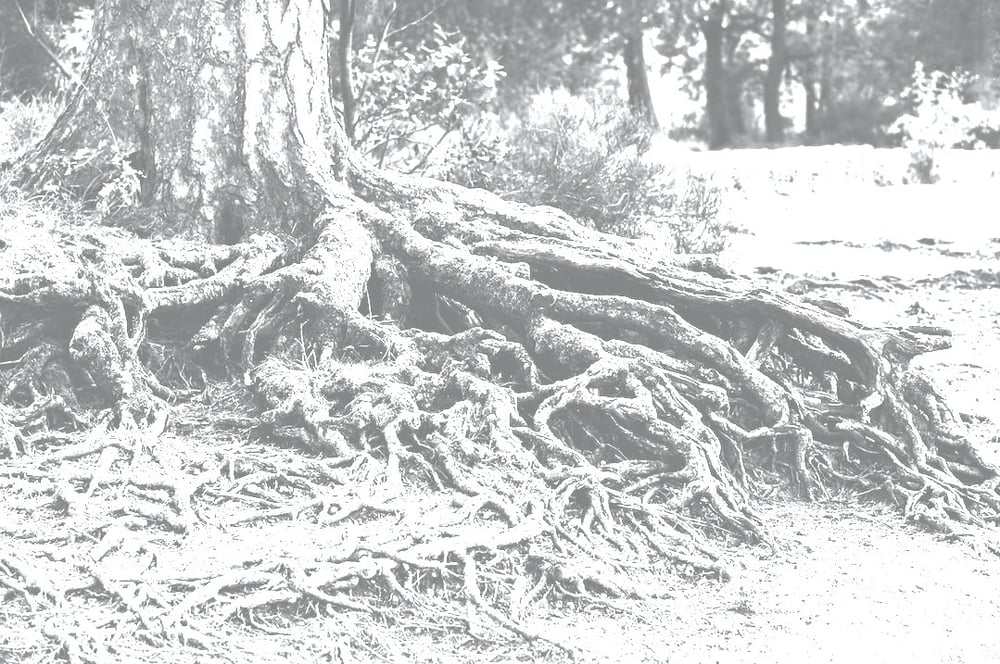

"Income Planning is the development

of a healthy financial ecosystem,

evolving from a robust system of roots."

Jed Maslowski

President - MAZ Income Planning Services

Income Planning

Income Planning can be broker down into two broad categories: Financial Protection (Insurance) and Personal Financial Goals (Short-Term and Long-Term).

Financial Protection (Insurance)

Personal Financial Goals

Your ability to reach financial independence is universally a top priority... Why retire at age 65 or 60, when you can think about retiring at age 55? Maybe even earlier?

But long-term goals are not always about retirement. they can also represent things like paying for your kids future college costs, starting a business, or building your dream home.

Short-Term and Long Term Financial Goals

Whatever your financial goals might be, there are two important financial obstacles you MUST overcome.

They are Inflation and Taxes.

If you fail to address either of these obstacles, it will be difficult for you to reach your long term goals. Advanced Life Insurance and/or Annuity planning can overcome both.

Wills and Trusts

Family estates, personal property, personal health, and business entities all need to be legally protected through wills and trusts.

A Will is a document that, after probate court, distributes your estate/assets to your beneficiaries once you have died. A Trust avoids probate court and allows you to retain control of your estate/assets both before and after your death.

Learn more from Trajan Wealth.

6 Considerations for Short Term & Long Term Planning

To overcome both inflation and taxes, you need to understand the following six considerations listed below.

Timeframe Handcuff

Is your long term savings plan handcuffed? Are you funding your long term savings with money that can only be used after a certain age? Most qualified retirement plans penalize you if you access your funds before age 59 1/2.

Designation Handcuff

What about "designation limit" handcuffs? Are you funding your long term savings with money that can only be used for a specific reason? For example, If you access your 529 college funding plan for reasons other than college expenses, you are penalized.

Taxes

Handcuff

For your long term savings, will you have to pay taxes when you finally access those funds? If yes, do you know what rate your money will be taxed? Wouldn't you rather pay NO TAXES? Remember, it's not about what you make, it's about what you keep.

Non-Deferred

Handcuff

Are you using a long term savings plan where you are paying taxes, every year, on the growth of your money? Your money should grow tax-deferred, meaning you pay no taxes as your money grows.

Protection

Handcuff

How safe is the your money from another recession? Is it possible that, in a year from now, you will actually have LESS money in your long term savings than you do today?

Inflation

Handcuff

Is your long term savings plan having trouble in keeping pace with inflation? In other words, are the increasing costs of everyday items (gas, electricity, consumer products, etc) growing faster than the monies inside your long term savings?

If you answered "yes" to any or all of those considerations listed above, you might not be maximizing income planning strategy.

A properly structured income plan, when designed optimally, should have:

• Cash values which grow tax-deferred.

• Cash values which are accessible at any time, without penalties or taxes owed.

• Cash values which are accessible for any reason, without penalties or taxes owed.

• Automatic participation, including double-digit growth, during "good market" years.

• Automatic protection from losses during "bad market" years.

• "Catch-Up" funding for missed years (if applicable).

Income Planning

Many, if not all of these benefits, can be found utilizing Indexed Universal Life insurance or Fixed Indexed Annuities. These plans require thought, preparation, and planning.

Like any long term financial goal, the sooner you can implement a plan, the better off you will be. Just look how valuable time becomes when your financial freedom is at stake!

View the video here, or check out our Lightning Fast Lessons page and watch other helpful videos talking about key factors you should look for when it comes to successfully planning your financial freedom.